Us Tax Revenue 2025. Government are individual and corporate taxes, and taxes that are dedicated to funding social security and medicare. Cutting the corporate tax rate to 18% from its current 21%, which was enacted in 2017's tax cuts.

President biden’s tax cuts cut child poverty in half in 2025 and are saving millions of people an average of about $800 per year in health insurance premiums today.

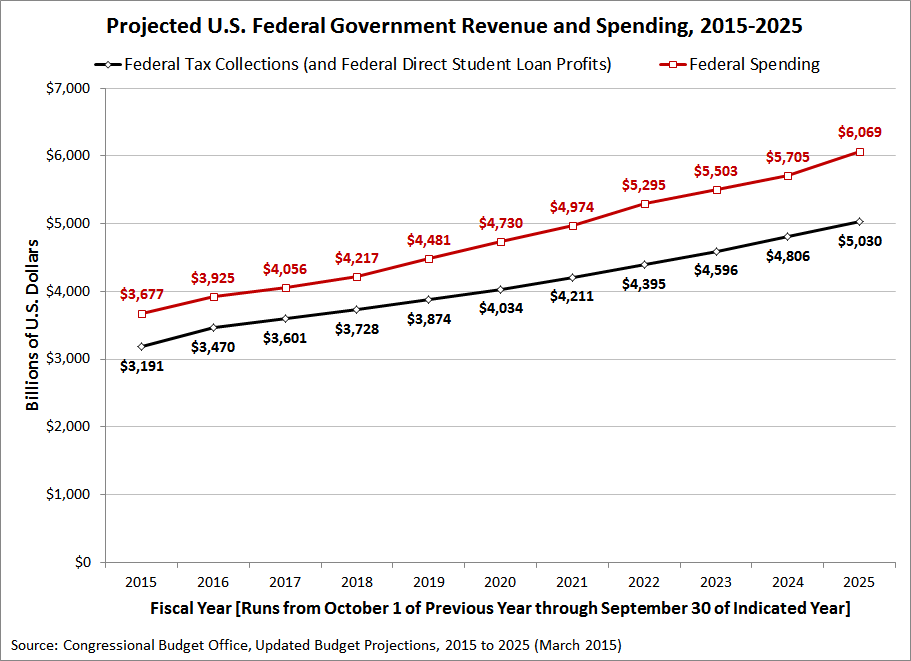

When Does Taxes Start 2025 April Brietta, Federal income tax rates and brackets. And instead of lawmakers looking at tax hikes to slow the growth in the national debt, they’ll likely to be trying to stave them off.

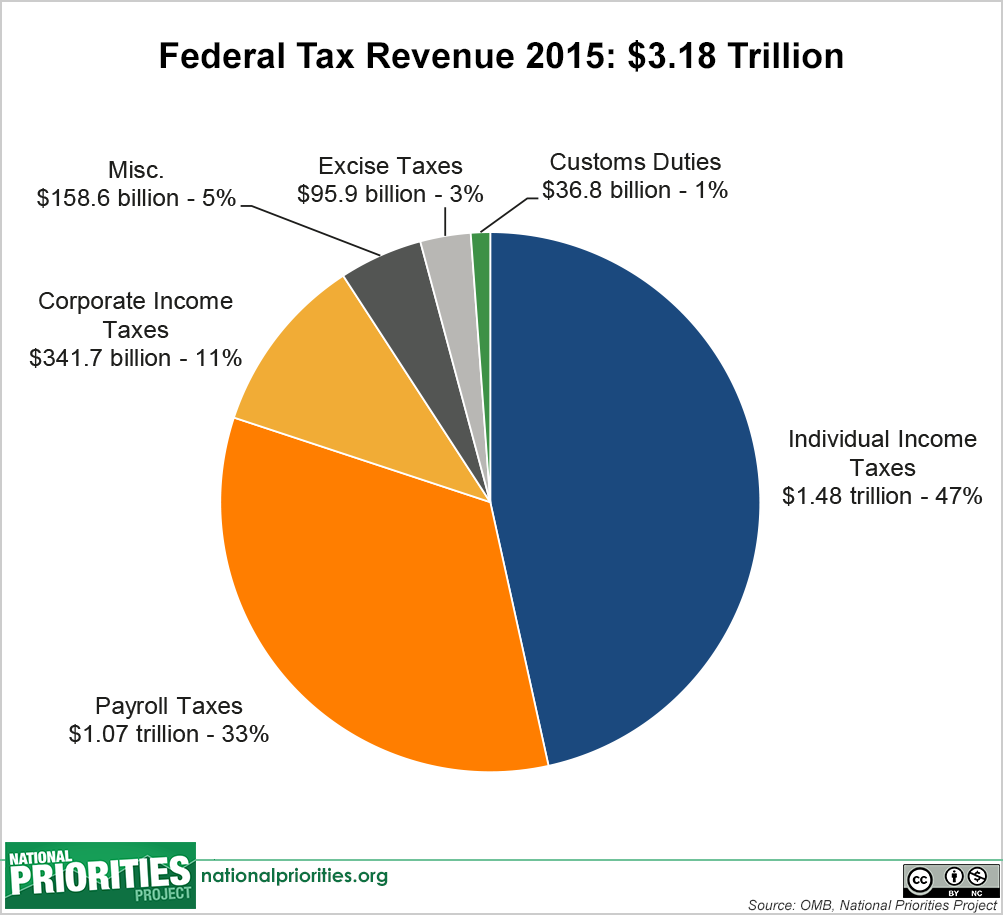

2025 Federal Tax Tables Janaye Sherill, What type of tax brings in the most revenue from the us government. In its fy 2025 explanation of the biden administration's revenue proposals issued on march 11, 2025 (green book), the united states (us) treasury explains several international.

T210120 Share of Federal Taxes All Tax Units, By Expanded Cash, The latest federal income tax data 2025 shows that the individual income tax continues to be progressive, borne primarily by the highest income earners. Tax revenue is raised at the state and local levels.

News & Blog MyGovCost Government Cost Calculator Part 2, Taxes would increase for most us households. Top tax rates under president biden’s fy 2025 budget.

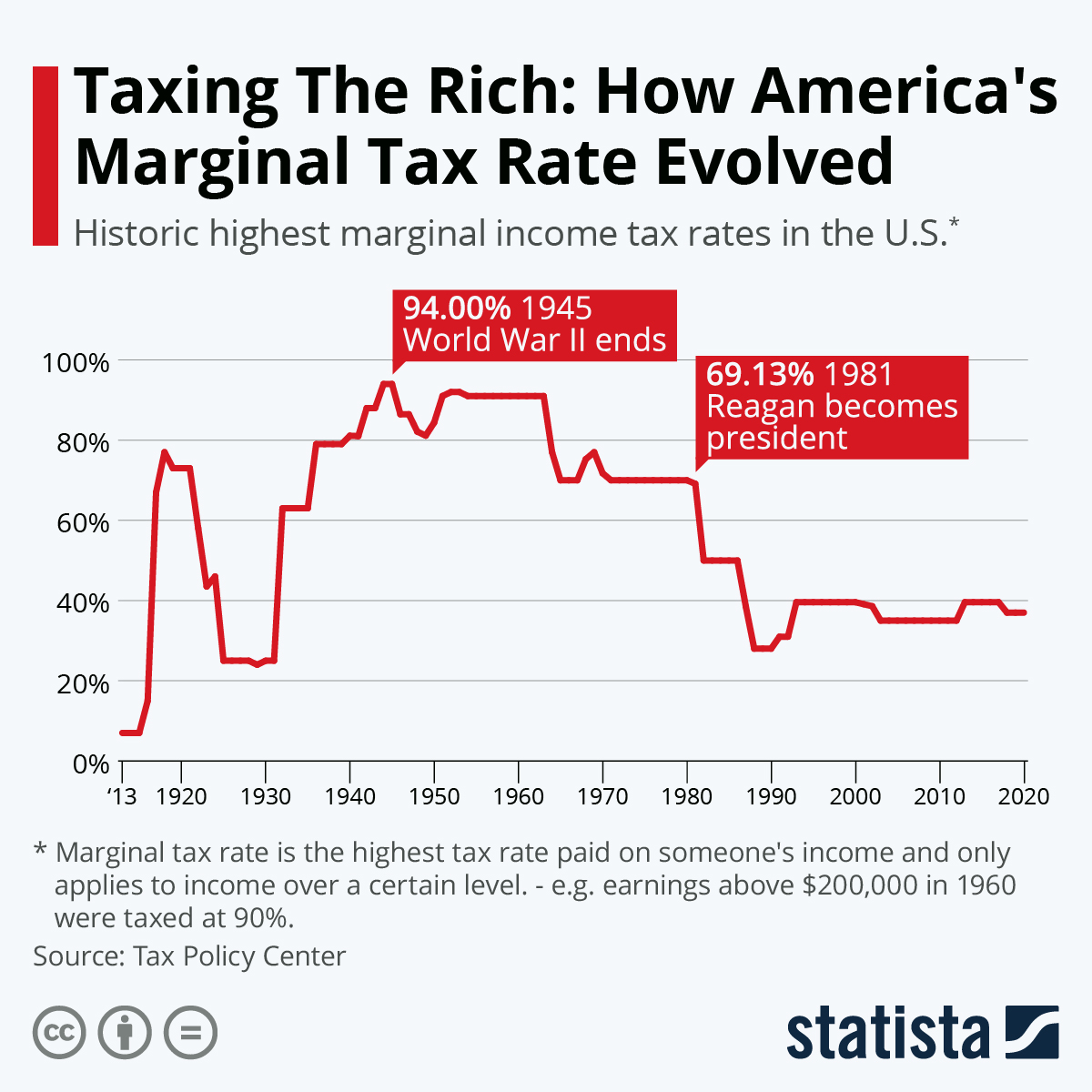

Chart Taxing The Rich How America's Marginal Tax Rate Evolved Statista, President biden’s tax cuts cut child poverty in half in 2025 and are saving millions of people an average of about $800 per year in health insurance premiums today. The latest federal income tax data 2025 shows that the individual income tax continues to be progressive, borne primarily by the highest income earners.

Federal Budget 101 How the Process Works Brewminate A Bold Blend of, President biden’s budget proposals would raise top tax rates on corporate income, capital gains income, and individual income to levels that are out of step with the rest of the world. See us federal tax revenue.

Sources of Government Revenue in the United States Tax Foundation, Every country’s mix of taxes is different, depending on factors such as its economic situation. Compare sources of us tax revenue by tax type.

Understanding Taxes in America in 7 Visualizations, Tcja lowered the corporate tax rate to 21%, a move with no end date, but deficit concerns and political pressures could change that. How does government revenue in the us compare to oecd countries?

-88ee-e466.jpg)

Us Tax Revenue By Year Chart, Federal income tax rates and brackets. Tcja lowered the corporate tax rate to 21%, a move with no end date, but deficit concerns and political pressures could change that.

U.S. alcohol tax revenue 2025 Statista Alcohol, Revenue, State, Every country’s mix of taxes is different, depending on factors such as its economic situation. Tax revenue is raised at the state and local levels.